The Compensation Lowdown: How Much Can You Expect to Earn as a Head of Corp Dev or M&A?

The Compensation Lowdown: How Much Can You Expect to Earn as a Head of Corp Dev or M&A?

Wondering what corporate development and M&A roles pay in private equity? Compensation typically mixes a strong base, performance bonuses, and high-upside equity/carry. Our data shows NYC healthcare Heads of Corp Dev clustering in the mid-$200Ks base, while PE-backed Heads of M&A trend toward the upper-$300Ks. Dive in for how bonuses and carry are structured—and what to expect when negotiating comp.

Taking on a corporate development or M&A role at a PE firm or PE-backed portfolio company can serve as a challenging and rewarding next career step for folks coming out of investment banking or management consulting. Potential candidates for these roles might well ask – what do salaries look like for these kinds of positions?

There are several components to the compensation for these types of roles. Total compensation packages typically include a base salary, bonuses, and often equity/carry (a portion of the profits that are generated from successful investments).

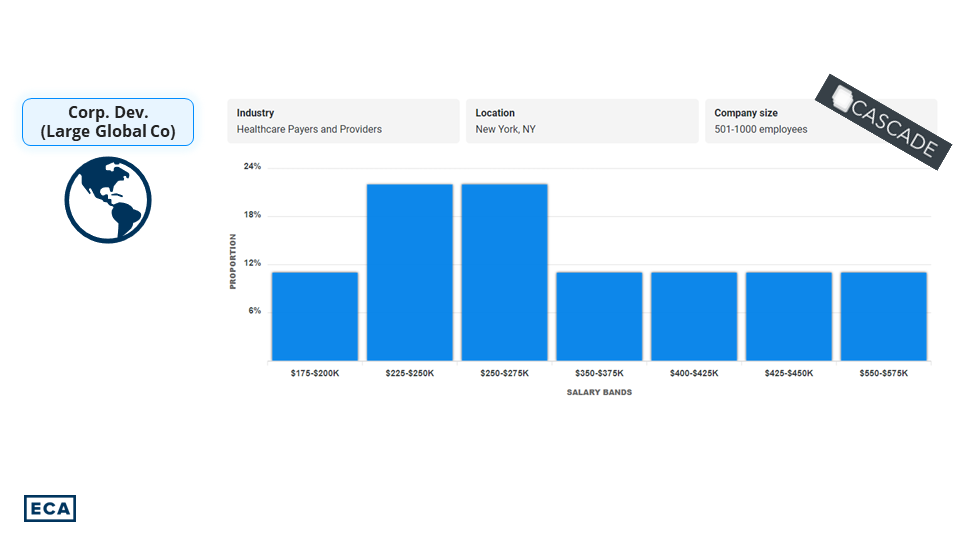

These roles can be highly compensated, but the specific packages on offer will vary according to several factors, such as the industry area and the region, as well as the size and type of company. For example, using information from ECA’s proprietary database, Cascade, we can see that there’s a large range for head of corporate development roles at large global companies. In the breakdown below of salary (base) for NYC-based corp dev roles in the healthcare space, we see that there is a spike around the mid-$200Ks, with outliers to either side.

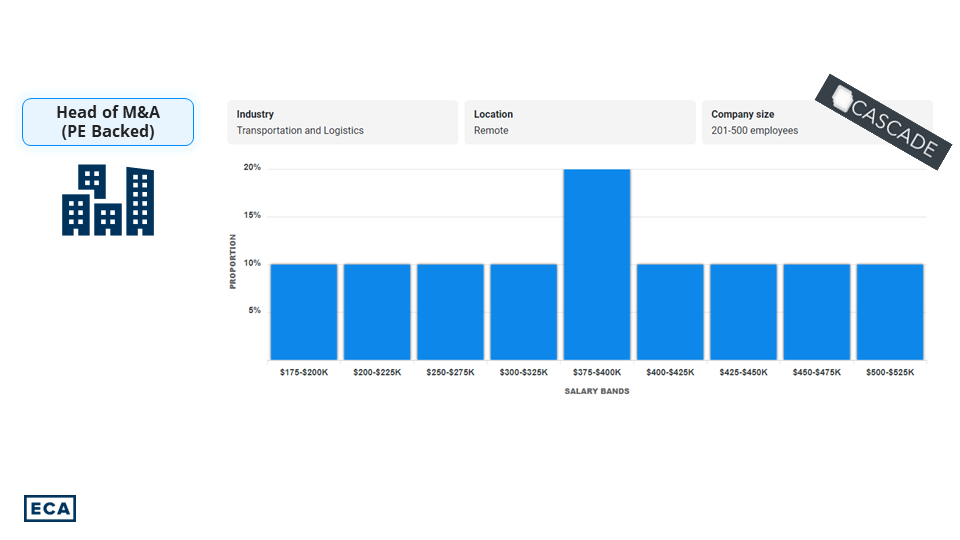

For head of M&A roles at PE-backed companies, we’re seeing a spread across a similar range, but with the spike coming slightly higher, in the upper $300Ks for the base salary.

It’s common for the compensation for roles like these, especially at the higher levels, to come with an equity component if the company is in the PE space, or other stock incentives if the company is larger and public. Equity/carry gives corp dev and M&A professionals a stake in the success of the investments they help to originate and execute. The amount of carry will vary according to the firm and specific role but can be a significant multiple of base salary and bonus. However, carry is high risk and high reward: if an acquisition fails or the fund does poorly, equity might end up being worth next to nothing.

Bonuses can also be substantial, but there is variability in how these are paid out. Bonuses might be anchored as a percentage of the base salary and related more to individual performance, but for corp dev and M&A roles, which are integral to the deals process, bonuses might instead be tied to the performance of specific deals or the overall performance of the firm.

In short, corp dev and M&A roles are in-demand, exciting, and often well-compensated options for investment bankers or management consultants who are searching for an exit into the next challenging phase of their career. Check out our videos with more details about the hiring landscape for these roles and what you can do to optimize your candidacy.

Kay Francoeur is a Project Manager at ECA Partners. She can be reached at [email protected]