Why PE Firms are Investing in Specialty Healthcare Practices

Why PE Firms are Investing in Specialty Healthcare Practices

Private equity in healthcareis shifting from saturated primary care to specialty clinics—dermatology, ophthalmology, orthopedics, pain management—where margins are richer and roll-up potential is stronger. Sponsors bring capital, EMR and analytics upgrades, and back-office scale to physician practices, accelerating value-based care adoption. Demographic and cultural tailwinds (aging populations, elective aesthetics, new tech) fuel growth, though smaller addressable markets and higher equipment/marketing costs remain risks. Explore how this specialty-focused healthcare M&A playbook creates value for providers and investors.

The Provider Perspective

The PE Perspective

Specialty Practices

1. Higher Margins

2. Value-Based Care (VBC) Infrastructure is Less Developed

3. Scarcity and Market Consolidation

4. Cultural Trends and Technological Advancements

Potential Challenges in Specialty Practice Investment

ECA Case Studies

1. Exurban Primary Care Practice

2. Urban Pain Management Roll Up

Conclusion

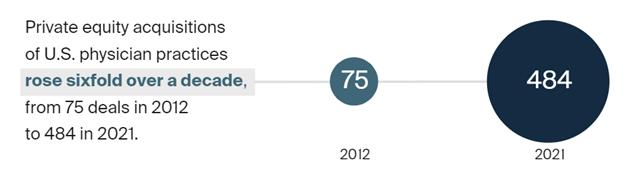

In the past 15 years, private equity firms have increasingly invested in physician-owned healthcare practices. The number of these acquisitions has grown from 75 deals in 2012 to 484 in 2021.1The estimated annual value of these deals has increased by over $60 billion dollars in the same period according to another report.2PE firms have begun focusing on acquiring specialty practices and rolling them up into platforms to consolidate regional markets. This recent trend of investing in specialty clinics has gained speed as the primary care market has become more and more saturated. This article will explore the principal reasons that PE firms have shifted their healthcare M&A strategy from general practice clinics to targeting specialty clinics and the potential impacts for both providers and investors.

Source: David Blumenthal, “Private Equity’s Role in Health Care” (explainer), Commonwealth Fund, Nov 17, 2023.

The Provider Perspective

Physician-owned practices often face challenges related to operational costs, staffing, technology upgrading, and administrative workload. PE firms promising to streamline these issues using their resources and expertise can present an enticing offer to over-worked physicians and clinical staff. PE firms provide capital and strategic guidance that can allow for upgrading of electronic medical record (EMR) systems, revamping outdated staffing models, building up data analytic and KPI-tracking IT infrastructure, and implementing more efficient expense handling software and purchasing systems. Physicians may be more inclined to partner with PE firms to help them achieve operational goals and growth metrics that may be out of reach without an infusion of outside capital. For example, many practices adopting approaches centered on value-based care (VBC) face clinical, technological, and operational challenges that require access to capital to overcome. A 2022 McKinsey report found that the number of patients being treated by physicians using the value-based care approach could nearly double in the next five years.3 This combined with declining Medicare and commercial payor reimbursements both serve as reasons that providers may look to PE firm investment to meet their clinical goals.4

Source: Ace Healthcare Solutions

Have a role you'd like to discuss?

Looking to expand your team?

The PE Perspective

PE firms often look for opportunities to consolidate multiple practices in a market to increase their market share within regions of interest. This consolidation can offer clinics and their PE firm owners more streamlined operational processes under one unified umbrella – an “economy of scale” – which can facilitate the implementation of value-based care and create more bargaining power with insurance providers and suppliers. Centralizing back-office functions by partnering with PE firms can help physicians save on administrative costs, and independent practices can have high upside potential in terms of improving operational processes to save costs and increase profits. Specialty clinics in particular present unique opportunities for inclusion in healthcare roll-ups.

Specialty Practices

Practices that focus on specialized healthcare procedures, such as dermatology, cardiology, or orthopedics, make appealing investment targets for PE firms for three key reasons.

1. Higher Margins

PE firms often target specialty practices within a specific area for investment because these practices administer more expensive procedures and prescriptions. Some of these procedures may be elective which are not covered by Medicare, resulting in ever higher profits for the practice. These procedures can yield more profit compared to most standard primary care services. For example, while primary care services may cost patients a few hundred dollars and are often covered by Medicare, Botox injections at a dermatology clinic can cost up to $800 with other aesthetic procedures costing over $2500. Recent years have seen an increase in patients undergoing aesthetic procedures at dermatology clinics and medical spas where a majority of the treatments may be elective and therefore more profitable to the clinic.

2. Value-Based Care (VBC) Infrastructure is Less Developed

While value-based care approaches are relatively straightforward to implement and generalize across primary care clinics, the highly specialized nature of specialty clinics with regards to equipment, clinical workflows, payor models, and insurance coverage has resulted in much slower adoption of VBC. Specialty clinics face a steeper hill to climb in implementing VBC in terms of the required infrastructure changes across clinical processes and the IT infrastructure required to meet VBC standards for metrics and reporting. PE firms can provide the resources and operational guidance needed to get clinics up to VBC standards. In many cases PE investment is the only way for independent specialty clinics to make the shift to VBC and get ahead of other specialty clinics.

3. Scarcity and Market Consolidation

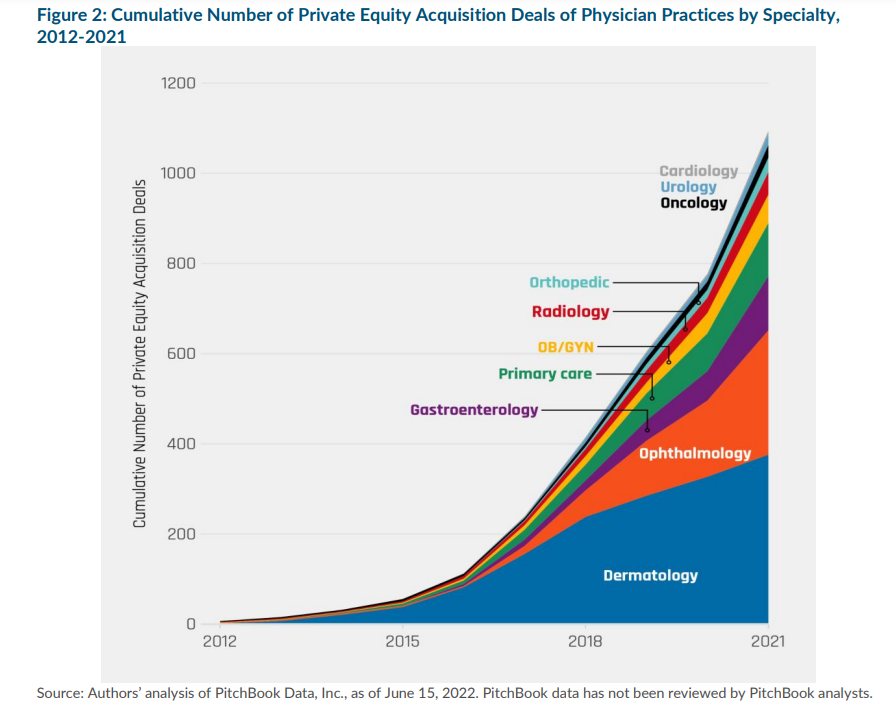

While a given region may have many primary care practices, there tend to be far fewer clinics for specific specialties, making it easier for PE firms to consolidate control over a given market. This is especially true for highly technical specialties. Primary care practices have been targeted for investment and consolidation since the early 2010s by hospital groups and PE firms due to their large numbers in urban areas, leading to market saturation. There is much more growth and consolidation potential amongst the different specialty discipline practices due to their smaller numbers and higher percentage of independent clinics – especially in exurban areas. This is reflected in a recent report on acquisitions by practice type that showed dermatology, ophthalmology, and gastroenterology made up over half of all PE healthcare practice acquisitions in the last 5 years (see graph below).5

4. Cultural Trends and Technological Advancements

Beyond market forces, cultural-level trends and technological advancements are also driving PE investment into specific specialties. With American life expectancy continuing to climb and the population aging, more and more people require joint replacements that can only be done by orthopedic specialists. Similarly, the large percentage of aging Americans experiencing macular degeneration and cataracts paired with advancements in optical care technology have led to increased investment in ophthalmology clinics. The rise of social media and increased access to cosmetic procedures has fueled public interest and PE investment in dermatology.6

Potential Challenges in Specialty Practice Investment

There are many reasons that PE firms are looking to invest in specialty practices, but these investments are not without risk. One important consideration is that everyone needs a primary care provider, but many people do not need a specialist provider. This means that the potential patient population for many specialty practices is much smaller than those of primary care clinics. Additionally, marketing will play a bigger role in terms of operating budget, especially for specialty practices that perform elective procedures such as dermatology. There are also other costs that primary care does not share in, including specialized tools, facilities, supplies, equipment, and additional training for clinical staff.

Source: 2023 AAI Report “Monetizing Medicine: Private Equity and Competition in Physician Practice Markets”

ECA Case Studies

At ECA we work with PE-backed companies to hire executives to help lead and grow both primary care and specialty practices. Two recent searches we completed showcase the types of strategic leaders that PE firms can bring to bear at their healthcare portfolio companies to drive process improvements, cost savings, and strategic vision.

1. Exurban Primary Care Practice

ECA recently partnered with a PE-backed regional primary care provider in exurban Southern California to place several roles including a Vice President of Operations and a Vice President of Human Resources. Over 80% of candidates that ECA presented to the client for the Vice President of Operations role went on to interview with them. The Vice President of Human Resources search was completed in 87 days.

2. Urban Pain Management Roll Up

We are currently partnering with a PE-backed multi-state pain management healthcare platform to build out their operations leadership. The searches we are conducting with this client focus on proven operations leaders with multi-site clinic management experience and P&L ownership. We presented a candidate within a week of one search beginning who went on to receive an offer for the role.

Conclusion

Higher margins, more consolidation potential, and the infrastructure investments required by VBC approaches are just a few reasons why specialty clinics have become increasingly popular as acquisition targets for PE firms. Despite the slowdown in acquisitions in 2023, the market looks to be heating back up in 2024.5 At ECA, we have hands-on experience helping PE-backed healthcare platforms bring in operations, finance, and strategy leaders. The growing demand for these leaders among our PE-backed healthcare clients reflects the current trend of investment in specialty healthcare practices. It also underscores the value that PE investment can bring to healthcare practices – strategic leaders who can implement process improvements, increase efficiency, and help clinics incorporate the latest technology.

Sources:

- Monetizing Medicine: Private Equity and Competition in Physician Practice Markets

- AHIP 2022 Private Equity Issue Brief

- 2022 McKinsey Report on Investing in the New Era of Value-Based Care

- 2023 AMA Article on Falling Medicare Physician Pay

- The Growing Trend of Private Equity Investment in Healthcare

- Pitchbook Q4 2023 Healthcare Services Report

Additional Reading: